Florida Department of Revenue

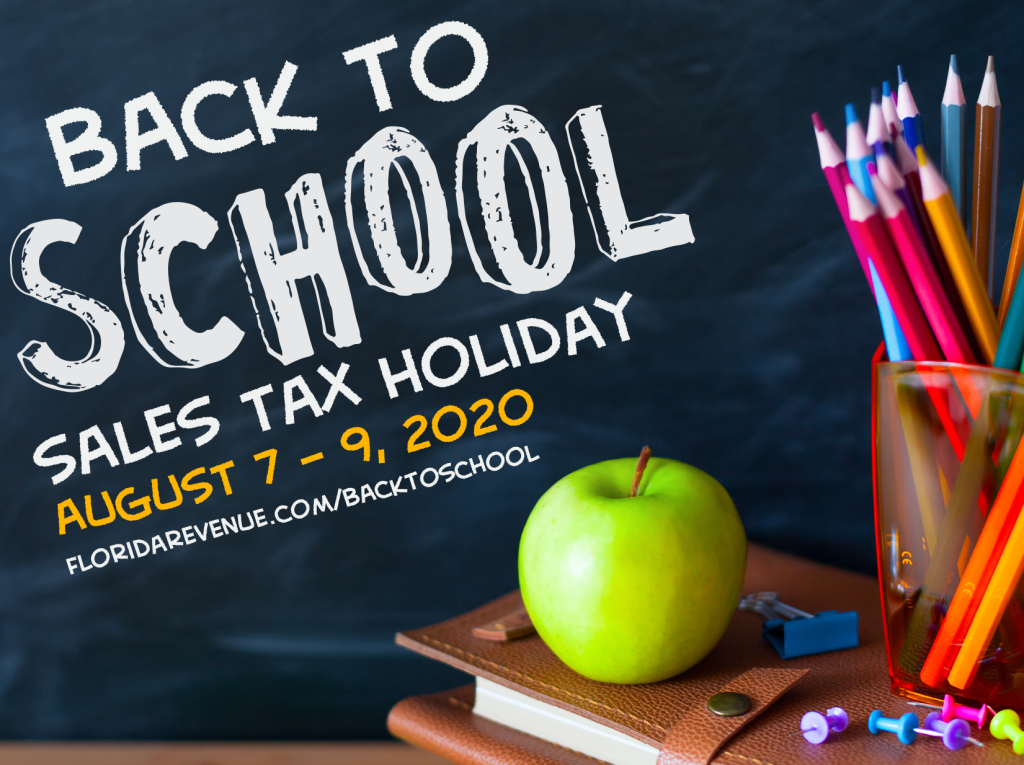

It's time to prepare those back-to-school shopping lists as the sales tax holiday begins this Friday, Aug. 7, and ends Sunday, Aug. 9.

During this sales tax holiday period, Florida law directs that no sales tax or local option tax will be collected on:

- Purchases of clothing, footwear, and certain accessories selling for $60 or less per item.

- Purchases of certain school supplies selling for $15 or less per item.

- The first $1,000 of the sales price of personal computers and certain computer-related accessories, when purchased for noncommercial home or personal use.

This sales tax holiday does not apply to:

- Any item of clothing selling for more than $60.

- Any school supply item selling for more than $15.

- Books that are not otherwise exempt.

- Computers and computer-related accessories purchased for commercial purposes.

- Rentals or leases of any eligible items.

- Repairs or alterations of any eligible items.

- Sales of any eligible items in a theme park, entertainment complex, public lodging establishment, or airport.

For more information, click here.

Katherine ViloriaWriter

Katherine Viloria is Beasley Media Group's Fort Myers Digital Content Manager. She loves to write, snap photos, and watch Grey's Anatomy. Connect with her on Instagram @alittlethisalittlekat